5 Lessons From The 2024 Cultured Meat Symposium

A quick breakdown and key lessons from the biggest cultivated meat conference.

Last week I was honored to attend the online portion of the 7th annual Cultured Meat Symposium (CMS). I’ve had a few days to reflect—join me for a quick breakdown of the event, my favourite parts, and key lessons.

*Disclaimer: I am not associated with CMS, and this is not intended to be an “official” breakdown, rather a perspective from someone new and interested in the space.

Key Takeaways

It’s unclear who will build the scale necessary for the space to be taken seriously. Governments need to play a funding role.

The industry downturn is very noticeable, with a consensus view we’re currently in the ‘Valley of Death’.

Cooperation through partnerships and specialisation is critical to escape the valley.

An interest in quicker revenue streams and paths to market through hybrid solutions.

A return to paying more attention and understanding authentic customers and their behaviours.

Conference Themes

Each year the CMS has official key themes—this year the focus was on:

Sustainability

Inclusivity

Growth

While these themes represent a lot of what the conference was about, for me, five big themes stood out:

Who’s building core scaling infrastructure?

Pivots—embracing hyrid meats, cooperation and speicalisation

Getting through the ‘Valley of Death’

Managing tough regulations

Putting the customer first

Let me touch on them individually 👇

#1 Who’s building the scale?

From the get-go, the question of who’s building core infrastructure was brought up, with both Anita Broellochs (Balletic Foods) and the first fireside chat with VC’s Alex Davisson (Plug and Play) and Steve Simitzis (Solvable Syndicate) raising the concern.

The consensus was VCs cannot play a part in this, and it needs to come from elsewhere.

A big focus was on governments not only enacting positive laws to spur adoption (and reject the current bans) but on providing financial support to build out these multi-million bioreactors and facilities. Perhaps telling, there were no government representatives on the main stage.

The analogy of the conference was comparing it to the solar industry, which has received incredible government subsidisation helping to propel the industry.

#2 Getting Through The ‘Valley of Death’

There isn’t a way to sugarcoat it, with multiple speakers bringing up the current ‘winter’ for cultivated meat.

Nothing backs this up then Paul Shapiro's (The Better Meat Co.) reflection on the slow movement of adoption 👇

“To be frank if in 2018 when the first conference happened you would have told me that in 2024 there would be no cultivated meat on the market in the United States it would have surprised me…I would have definately thought there would be more commeralisation [that has] actually happened”

I counted three to four speakers who mentioned the ‘Trough of Disillusionment’, also known as the ‘Valley of Death’. See the below chart from David's presentation.

If you haven’t seen this graphic before it represents a typical hype cycle common in emerging technologies.

Expectations getting out of control, drying up of funding, slower-than-anticipated commercialisation, and cultivated meat companies closing have resulted in lower sentiment.

But there’s hope.

Cultivated meat isn’t the first industry to go through the hype cycle and ‘winter’ (see previous AI and crypto winters). The industry is looking towards reaching this slope of enlightenment and proving productivity with products (hopefully) finally hitting the market.

#3 Pivots—Embracing Hyrid Meats & Specialisation

Embracing hybrid meats was a hot topic—from incorporating cultivated meat with traditional meat agriculture products to unique blends of plant-based and cultivated meats.

It was hard not to notice the panel being well represented by cultivated fat companies whose products offer a quicker way to market.

The pivots continued, with my second favourite talk from the event, Max Huisman from Prolific Machines. He nailed the core event themes of ‘growth and inclusivity’.

Once focused on creating cultivated meat themselves, they’ve admitted they’re best able to push the space forward by providing a unique toolkit and platform harnessing the power of light to control the formation of cells.

They’ve not limited themselves just to cultivated meat but other emerging industries—although Max is quite sad he will never create it himself!

#4 Putting The Customer First

Probably my favorite talk was from Josh Errett from the Friends and Family Company. Josh offered a fresh look at the industry, pulling no punches as he stressed the importance of putting the customer first.

From his own experiences, he claims the industry has largely failed by neglecting to speak directly with consumers, and instead focusing on scale. (However, this is hard to do when these products cannot legally be offered to test customers)

"How you would want to scale and make thousands of products when you haven’t sold a single product — when you don’t know what the consumer says from one product and you haven’t sold ten products”

For Josh, pet food is the way forward for quicker market penetration which the consumer is asking for. After all, there is an underlying demand for vegans to give their cat friends (who cannot eat plant-based) harm-free fish cat food.

#5 Managing Regulations

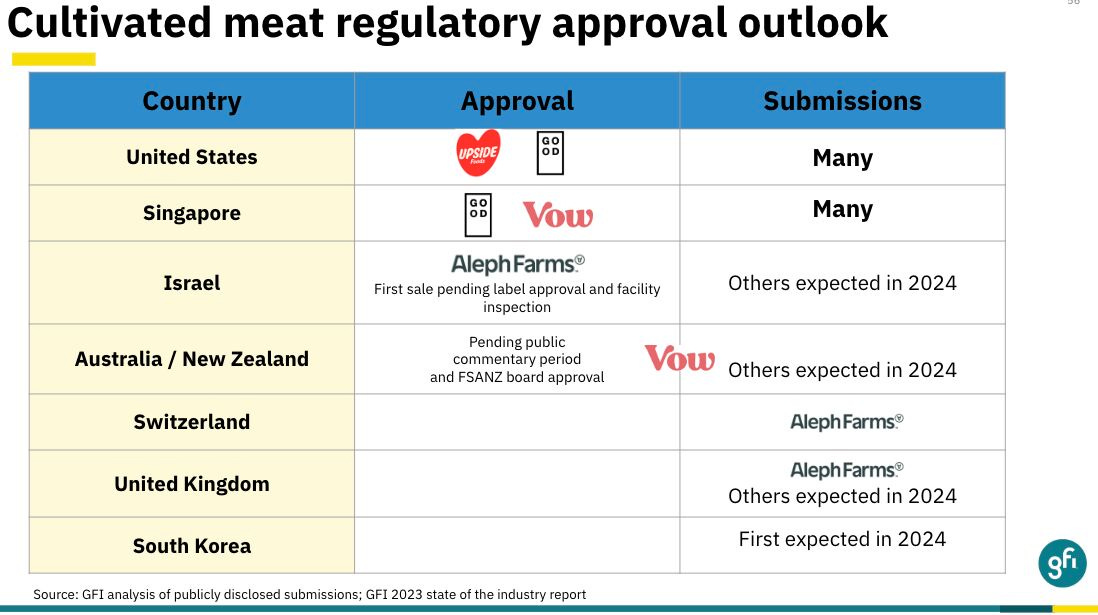

Brian Sylvester from Perkin Colen provided a regulatory update which is much needed given cultivated meat is facing its biggest challenge yet, with bans in Florida and Alabama.

What should we expect?

I got the sense things are going to get a little worse before they better. Michigan, Arizona, and Tennessee have tried and failed to place their own bans, so we should expect more attempts ahead.

There is some hope with Upside Foods fighting the action in Florida.

According to Brian, we should be on the lookout for FDA draft guidance into 2025 on things like labeling guidelines for cultured meat and hybrid meat.

The big unanswered question was ‘Will cultivated meat face the same tough stringent approval process as the biotechnology and life sciences market?’ to which there were no firm answers but rather hope that it isn’t the case (as it might impact things like number of approvals and time to market).

Unanswered Questions

It would be unfair not to mention one of the biggest talking points of the event—creating next-gen bioreactors to achieve the lofty and fabled ‘growth’ theme.

Masanobu Kowaka from IntegriCulture Inc. gave his argument on why we should rethink bioreactor design, but I couldn’t help but notice a key stat from the weekend.

20,000 litres

Kara from the Integrative Center for Alternative Meat & Protein (iCAMP) pointed out the biggest cultivated meat bioreactor is 20,000 liters, which is still only a drop in the ocean to meet the lofty goals set by the industry.

A fitting way to end this round-up, as it brings us back to the first question of how the industry can work towards meeting the huge infrastructure requirements to scale.

Mike Wolf (The Spoon) offered an alternative take, elaborating on the importance of retrofitting existing facilities.

Recap

Although the industry is going through a downturn & in the middle of the ‘Trough of Disillusionment’, there’s a lot to be positive about. We have to remember that cultivated meat isn’t the first to enter this valley and won’t be the last.

Here’s hoping for greater regulatory clarity in 2025, a uniting of companies and governments to pursue scale and finally enter this new growth phase for the industry where live products finally hit the market.

Love the breakdown!